If you re looking to meet a particular savings goal a cd calculator lets you quickly change period lengths deposit amounts and apy rates to find the right option.

1 year cd interest rate calculator.

If interest rates are falling choose a long term cd so you lock in the higher rate for the cd s term.

If interest rates are climbing choose a shorter term cd so you aren t locked in to a lower rate.

In late 2007 just before the economy spiraled downward they were at 4.

Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators publishing original and objective.

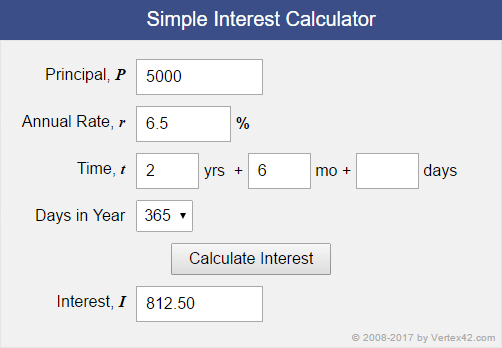

For the first year we calculate interest as usual.

How much interest you earn on your 360 cd account will depend on how much you deposit your specific term and interest rate.

Cd rates could change significantly in a year and you might not want to miss out on a.

A cd s apy depends on the frequency of compounding and the interest rate.

For example a 10 000 deposit in a five year cd with 1 50 apy will earn about 773 in interest while a cd with 0 01 apy all other factors the same only earns 5 in interest.

Cd calculators allow you to quickly determine how much you re going to make with a particular cd option.

If you have 15 000 to invest you could invest 5 000 in each rung.

5 000 in a one year cd.

Consider interest rate trends to decide on the ideal term for your cd.

Cd rates have declined since 1984 a time when they once exceeded 10 apy.

100 10 10.

A 5 year cd while a 5 year cd might have a higher apy a shorter term cd can be a better option.

In comparison the average one year cd yield is around 0 4 in 2017.

For instance a cd laddering plan of three cds might have a one year cd a two year cd and a three year cd.

Since apy measures your actual interest earned per year you can use it to compare cd s of different interest rates and.

On the other hand cd rates have dropped to as low as standard savings rates during certain years.

Choosing the right type of cd.

Want to see.

This interest is added to the principal and the sum becomes derek s required repayment to the bank for that.

Compounding interest requires more than one period so let s go back to the example of derek borrowing 100 from the bank for two years at a 10 interest rate.