A certificate of deposit that allows the bearer to deposit additional funds after the initial purchase date that will bear the same rate of interest.

3 year certificate of deposit name of fund or bank.

Use the unclaimed funds feature on the fdic website to locate your cd.

If the bank is not open anymore and failed within the last 18 months the fdic or another bank might have possession of your account.

To open a cd the account holder makes a one time deposit then leaves the funds to grow until the cd matures.

Certificates of deposit or cds are time deposits bought by an individual in order to earn an established rate of return within a fixed time period.

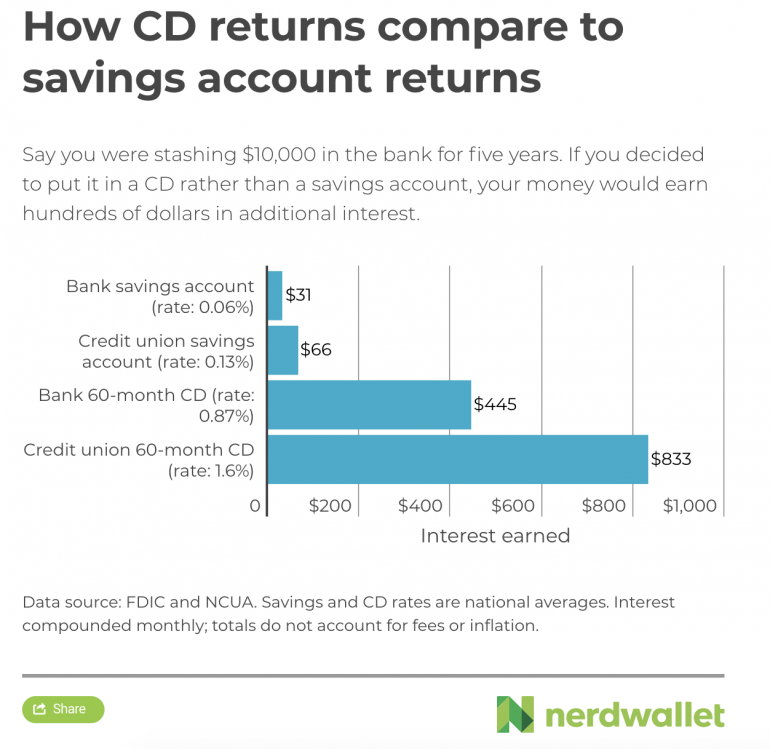

A certificate of deposit cd is a time deposit a financial product commonly sold by banks thrift institutions and credit unions cds differ from savings accounts in that the cd has a specific fixed term often one three or six months or one to five years and usually a fixed interest rate the bank expects cd to be held until maturity at which time they can be withdrawn and interest paid.

Add on certificate of deposit.

3 year cd rates are usually higher than 2 year cd rates but lower than 4 year cd rates and are considered a mid to long term cd in terms of maturity period.